Big Tech shares lose lustre as US market rocked by violent rotation

Simply sign up to the US equities myFT Digest -- delivered directly to your inbox.

Big Tech stocks are “no longer the only game in town”, according to investors who over the past week have moved out of the megacaps that have driven the market rally for years in favour of smaller companies and other previously unloved sectors.

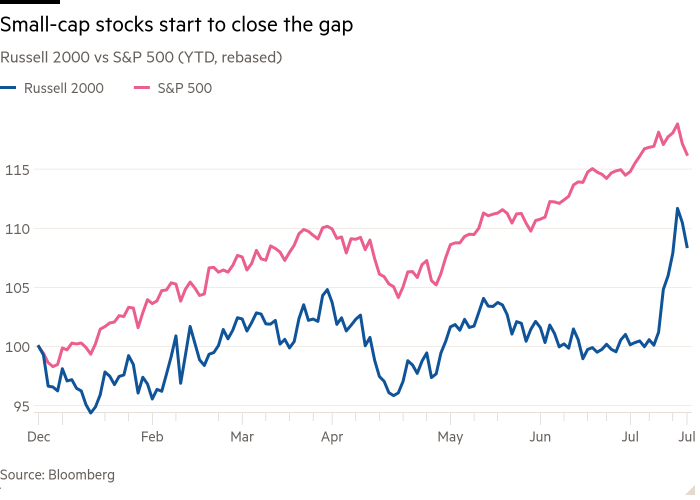

The Russell 2000 small-cap index has jumped 7 per cent since last Thursday, in a dramatic market shift sparked by falling inflation and encouraged by an improving earnings outlook.

Meanwhile, the so-called Magnificent Seven — megacap tech stocks that have dominated the blue-chip S&P 500 index’s gains over the past year, fuelling anxieties about an increasingly lopsided rally — have fallen. The losses, exacerbated by a global sell-off in semiconductor companies, came as the majority of other stocks in the index have climbed, led by sectors such as financials, energy and real estate.

“All of a sudden we have a larger menu to choose from, whereas last year there was really only one thing on the menu,” said Jurrien Timmer, director of global macro at Fidelity. “When you have a more broad-based earnings recovery and a Fed pivot at the same time and the bond market is being well-behaved, there are other things to buy now too.”

Investors have long been hoping for a broadening out of gains in the US market. The S&P 500 advanced 14 per cent in the first half of 2024, but the reliance on a few large companies raised concerns about the fragility of the rally.

While passive fund investors profited, for active fund managers the narrowness of the rally made it difficult to keep up with their benchmarks, because so few companies outperformed the overall index and many managers were wary of holding such large positions in just a handful of stocks.

Inflation data published last week solidified investor hopes of an interest rate cut in September by the Federal Reserve. Smaller companies have particularly benefited from the shift in expectations because groups in the Russell 2000 tend to have higher debt burdens than large-caps. While lower rates have also traditionally been good news for fast-growing tech companies, many of the largest ones have received a boost to earnings from high interest rates because of their enormous cash piles.

Gains over the past week have been broad-based, with more than 1,500 of the nearly 2,000 companies in the Russell index rising. The equal-weighted version of the S&P 500, meanwhile, has outperformed the benchmark index, climbing almost 3 per cent, while the cap-weighted version fell.

Some market participants say the violence of the market rotation is partly a result of investor positioning; analysts at Bank of America noted on Thursday that short covering was a crucial driver of the rally in the Russell 2000 in particular, with heavily-shorted stocks among the best performing.

“I think a lot of people were caught offside,” said Brandon Nelson, a portfolio manager at Calamos who specialises in small- and mid-caps. “There was some complacency with people parked in the megacaps and ignoring or even shorting small-caps, because that had been the right pair trade for so long.”

Meanwhile, having fallen well behind the earnings growth of the Magnificent Seven last year, other companies’ profits are now improving as megacap tech stocks’ earnings growth slows.

“The rest of the [S&P 500] was in a technical profits recession last year,” said Savita Subramanian, head of US equity and quantitative strategy at Bank of America. “As growth broadens out we think investors should become a little bit more price sensitive and move towards these cheaper, more cyclical companies.”

However, it would take a brave investor to write off the prospects of further positive surprises by the megacap tech stocks.

Nvidia dropped 13 per cent in the five trading sessions following last Thursday’s data showing a sharper than expected fall in US inflation. The last time it suffered such a large fall over a five-day period it followed it up with a 72 per cent rise over the next two months.

Jim Tierney, a growth-focused portfolio manager at AllianceBernstein, said the underlying trends that had driven growth in the Magnificent Seven and other artificial intelligence-linked stocks “are very much intact”, but suggested the relative strength of their earnings compared with the rest of the market was likely to wane.

“From a fundamental perspective the Magnificent Seven is no longer the only game in town where you can find growth,” he said.

Although many investors have been waiting for a sustained broadening out of gains, it may not mean good news for the overall index. More than 350 of the stocks in the S&P 500 rose in the week following the inflation release, but the index itself dipped 1.5 per cent because of the heavy weighting of the largest tech groups.

Whether the index can keep rising “depends whether new money is coming into the market and chooses to be in other stocks rather than the Magnificent Seven, or if it’s all an internal rotation where investors sell the Mag Seven to buy everything else”, said Fidelity’s Timmer.

He and several other analysts also highlighted the delicate balance required for smaller companies to keep rising: they need the Fed to start cutting rates, but without a big economic downturn that could damage their earnings. Market moves on Thursday highlighted this risk, with the Russell 2000 falling back 1.9 per cent after data showing jobless claims at their highest level since 2021.

Even after the gains over the past week, small-caps and the equal-weighted version of the S&P 500 are still trailing well behind the benchmark S&P 500, and investors are wary of getting carried away.

“You’ve closed the gap a little bit in the last week,” said Nelson at Calamos. “But you can’t undo years of underperformance in five days.”

Comments